Optimizing financing policy includes deciding how much liquidity a company should carry. In this post we find the value of an extra dollar of cash on the balance sheet.

What Does a Share Buyback .. Buy?

Answer: nothing.

If you invest in a private equity fund, the general partner is tasked with investing your funds. If she can’t find anything to buy, she returns the unused capital, shrinking the fund. This is the economic equivalent of a share buyback. Distributions of this sort don’t buy anything.

But the word buy in share buyback can be confusing. [Read more…]

Optimal Capital Structure with Business Disruption Costs

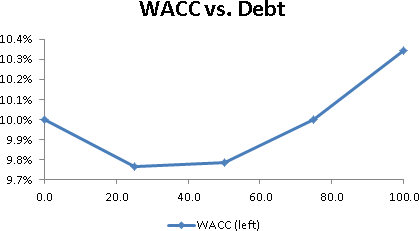

In an earlier post we showed that, for a tax-paying firm, WACC is always a declining function of leverage. If firm value is an inverse function of WACC, this suggests funding operations with 100% debt.

In fact we observe that firm value is concave in leverage and appears to peak when there is some equity in the capital structure. We’re forced to conclude that firm value isn’t solely a function of WACC, but instead varies in a more complicated fashion with leverage. In this post we’ll review one theory that explains this, and which can guide us in divining an “optimal” capital structure. [Read more…]

Use Distance-Based Peer Analysis

In an earlier post we saw how peer analysis can mislead. In this post we suggest a better method: distance-based peer analysis. [Read more…]

Share Repurchase Myths

There’s a surprising amount of misleading writing about capital distribution, and in particular the issue of dividend vs. share repurchase. In this post we’ll examine some common canards. [Read more…]

The Economic Irrelevance of Distribution Form

A recent article in the Economist suggests that managers with exposure to their firm’s share price would benefit by reducing dividends and instead buying back shares. From a strictly economic point of view, we don’t see the difference. [Read more…]

The End of Dividends

Once the dominant form of capital return, regular dividends have been in secular decline since the early 1980s. In this post we consider why. [Read more…]

Calculate WACC With Debt Beta

Calculating WACC correctly should preclude its use to optimize capital structure. In this post we’ll see why.

Traditional WACC Calculation

There was a time when WACC was used to find an “optimal capital structure”, which meant a debt/equity ratio that minimized the cost of capital. Charts like this were part of the argument:

Consider Asset Duration Matching

Separately from overall debt capacity, debt structure reflects specific choice of capital structure instruments. We address the goal of maximizing shareholder value in two ways:

- In good times, minimize the expected funding costs of the firm

- In bad times, minimize the costs of financial distress

In this post we consider duration matching, which clients occasionally propose. [Read more…]

Determine Analysis Type and Information Needs

Corporate Finance Analysis

Better analysis requires more information. In this recipe you will learn

- What defines quantitative corporate finance analysis

- The spectrum of analysis types

- The data (company fundamental or market) required for each type

- Trade-offs

The Availability of Data

Information is difficult and costly to acquire. This issue is at the forefront of quantitative analysis, which elevates the reliance on data in decision making. The following diagram lays out, left to right, the use of increasing amounts of information: [Read more…]

Welcome to QuantCorpFin

Welcome to Quantitative Corporate Finance. This post introduces the quantcorpfin.com site, including its purpose, content, and intended audience. [Read more…]