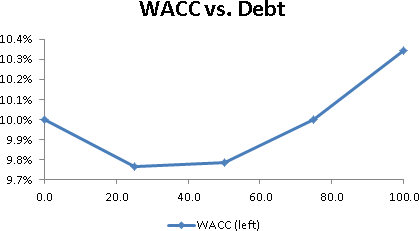

In an earlier post we showed that, for a tax-paying firm, WACC is always a declining function of leverage. If firm value is an inverse function of WACC, this suggests funding operations with 100% debt.

In fact we observe that firm value is concave in leverage and appears to peak when there is some equity in the capital structure. We’re forced to conclude that firm value isn’t solely a function of WACC, but instead varies in a more complicated fashion with leverage. In this post we’ll review one theory that explains this, and which can guide us in divining an “optimal” capital structure. [Read more…]