Calculating WACC correctly should preclude its use to optimize capital structure. In this post we’ll see why.

Traditional WACC Calculation

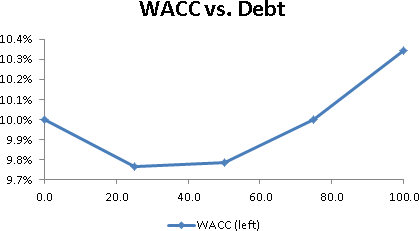

There was a time when WACC was used to find an “optimal capital structure”, which meant a debt/equity ratio that minimized the cost of capital. Charts like this were part of the argument: